We test your renewable energy products, not your patience.

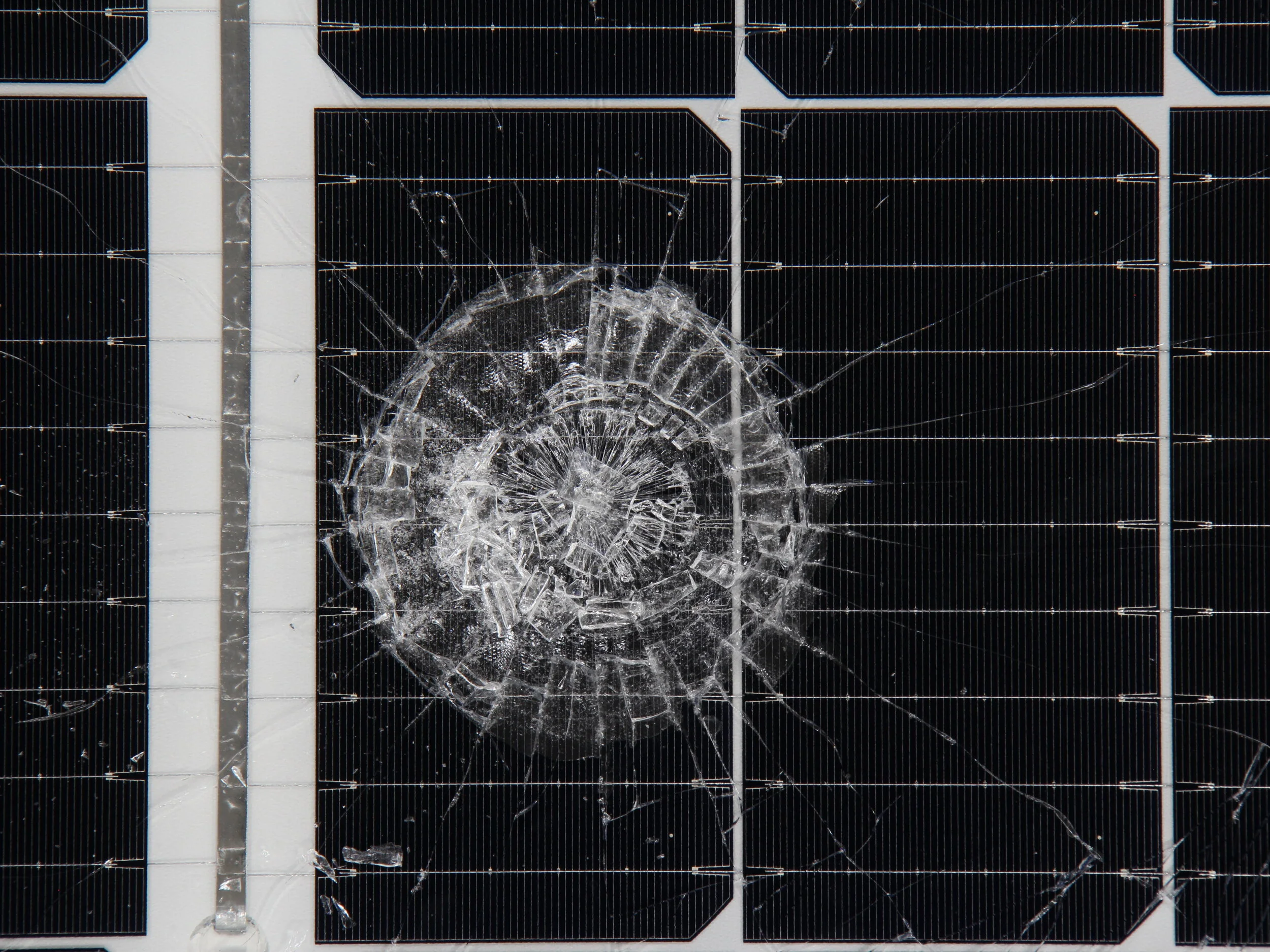

Renewable Energy Test Center (RETC, LLC) is a leading engineering service and certification testing provider for photovoltaic & renewable energy.

We test products from a broad range of module, inverter, storage, and racking manufacturers—and we're great at it too!

RETC is empowered by the belief that our work

is enabling a safer, more sustainable future.

Redefining the vetting

process for renewables—

We’ve done it before.

RETC prides itself on putting customers at the forefront while bringing value at all stages—from R&D, market-entry, to bankability. Since 2009, we’ve worked alongside our customers to provide specific, data-backed reports and meaningful evaluations on their product performance, all while balancing the latest testing standards and industry-accepted methods of vetting products. Our company understands what matters to our partners: quality service, timeliness, financials, focusing on risk & derisk, and changing BOM’s.

Ready to take the next step?

Whether you’re a manufacturer, investor, financier, or independent engineer, we can deliver on your product testing needs.

Giving Back

RETC gives modules a ‘second life’ by donating reused and refurbished PV modules to vulnerable, underserved communities without electricity. We knock out two birds with one stone: vetting our partners’ products responsibly & sustainably.