Rise of Solar-Plus-Storage

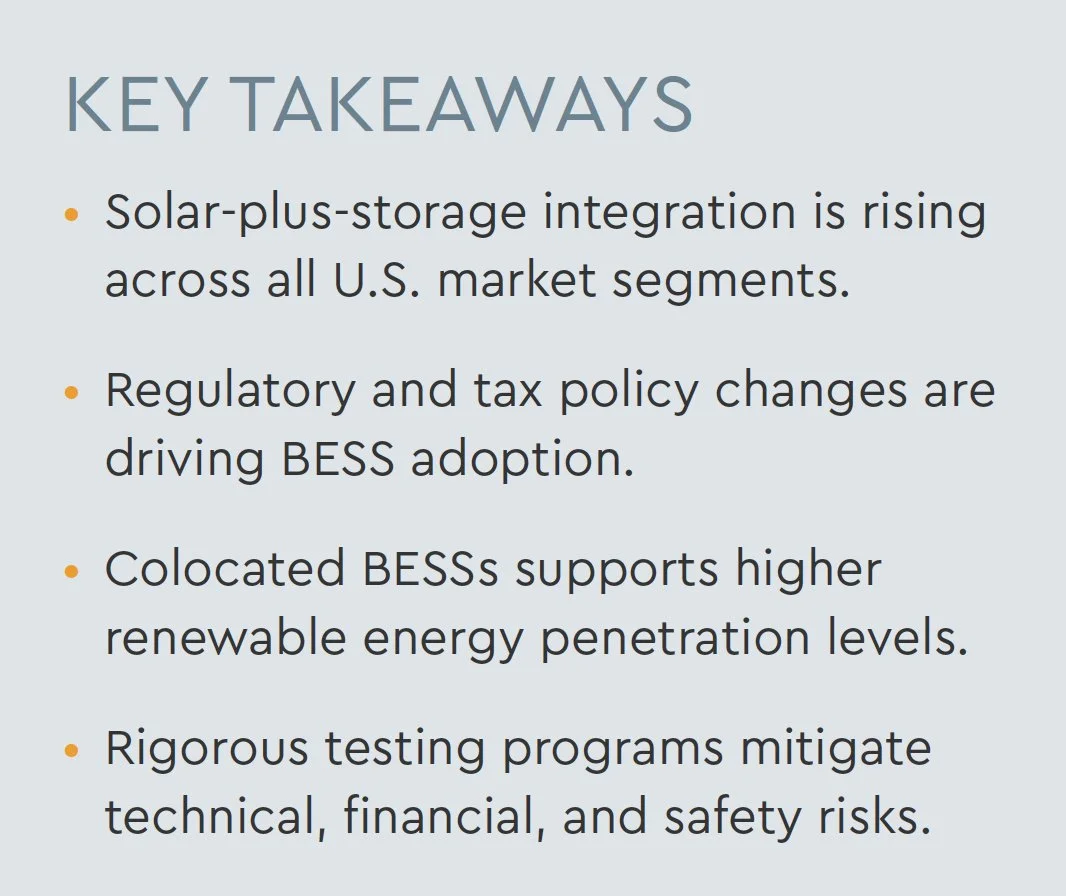

As variable renewable resources displace dispatchable fossil fuel plants as inputs to the bulk power system, energy storage deployments will provide system operators with a flexible new source of grid-firming capacity.

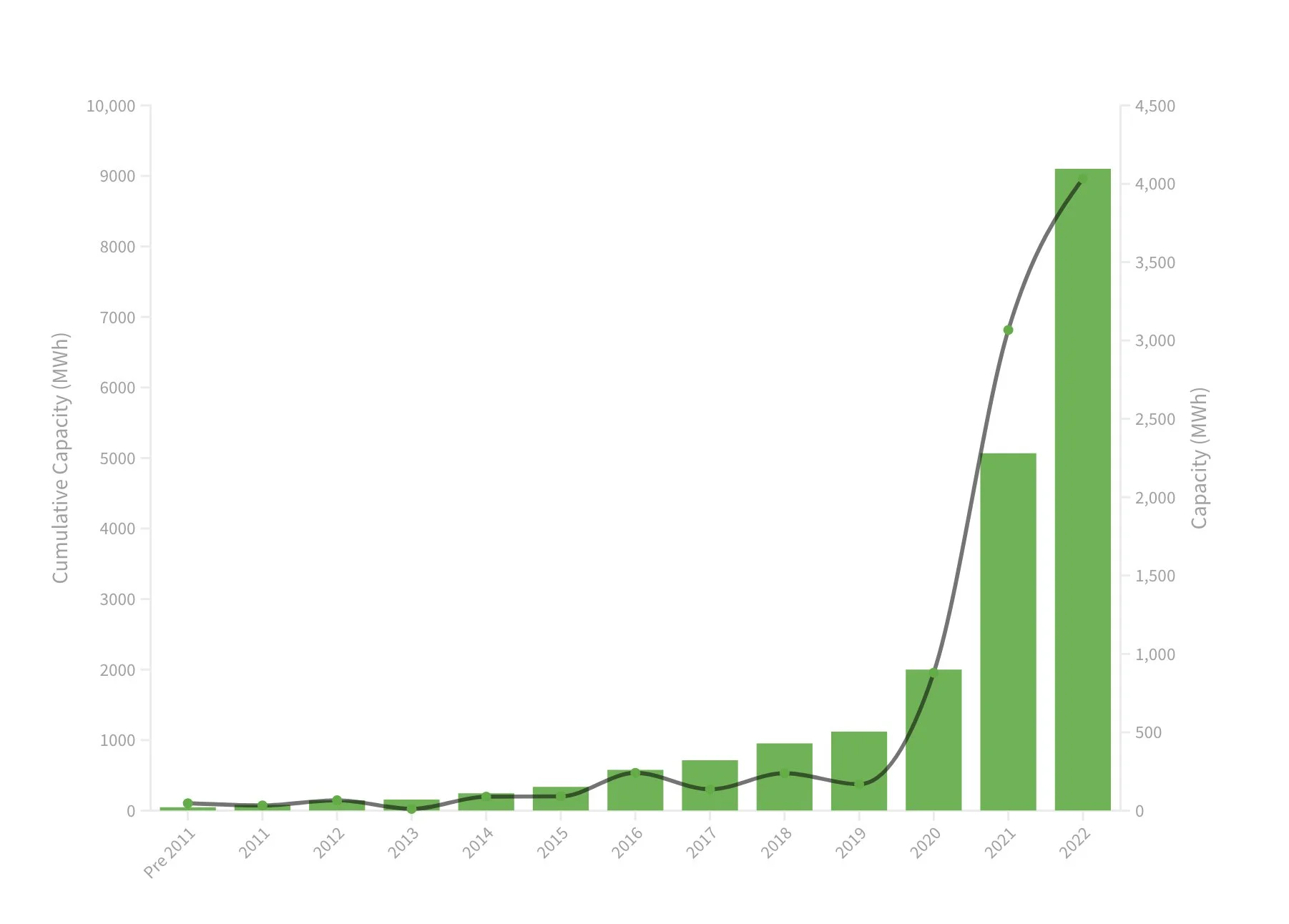

2022 was a record year for battery storage, with 4,034 MW/12,149 MWh commissioned. [See ACP]

Energy storage is foundational to collective efforts to avert a global climate crisis via electrification and decarbonization. To maintain power quality and system reliability, grid operators must continuously maintain a balance between generation sources and served loads. Increasing the deployment of short- and long-duration energy storage capacity will provide system operators with a flexible new source of grid-firming capacity.

Today, this market trend is most evident in the United States, which leads the world in battery energy storage systems (BESS) adoption. According to American Clean Power’s Annual Market Report 2022, cumulative BESS operating power capacity (MW) and cumulative energy storage capacity (MWh) increased respectively by 80% and 93% last year, a record-setting upward trajectory. BESS integration in the United States is rising across all market segments—residential, commercial, and utility—and most fielded BESS capacity is colocated with solar.

BEHIND THE METER

California is ground zero for residential solar-plus-storage integration in the United States—accounting for 47% of the country’s residential BESS installations in 2022—and a harbinger of things to come in other state markets. Due to generous net-energy metering policies and relatively high electricity rates, the Golden State has long been the country’s top residential solar market. In recent years, solar-plus-storage integration has also increased as the state’s grid resilience has suffered due to global-warming–induced wildfires and heatwaves, driving consumer demand for backup power.

Given the state’s ambitious carbon neutrality goals and first-of-its-kind residential solar mandates for new construction, the California Public Utilities Commission’s unanimous vote to eliminate net-energy metering confounded stakeholders in solar trade associations and environmental organizations. The state’s new Net Billing Tariff slashes payments for solar exports.

“Under the Net Billing Tariff, solar customers get reimbursed for excess power at the ‘avoided cost’ rate, which is less than $0.05 per kWh—and often zero—during peak daytime generation hours,” explains Barry Cinnamon, CEO of Cinnamon Energy Systems. “Without batteries, the payback period for standard solar installations in California will double for most customers. Adding one or more batteries increases up-front costs but recovers some savings from the loss of net metering by reducing solar exports and increasing self-consumption.”

Though this regulatory change surprised many Californians, other high-penetration solar markets—such as Hawaii and Germany—have charted a similar course. By reducing the value of solar exports, California’s new residential rate structure sends a strong price signal to the market in favor of zero-export self-consumption schemes that pair rooftop solar with behind-the-meter energy storage. Analysts expect the state’s residential storage attachment rates to increase to over 80% by 2027—up from about 11% today—as companies such as Sunrun launch new hybrid solar-plus-storage product offerings.

IN FRONT OF THE METER

BESS adoption in the United States is also increasing in utility-scale applications. Wood MacKenzie estimates that the U.S. market installed 4.0 GW of grid-scale energy storage in 2022, accounting for more than 83% of new operating capacity across all market segments. While stand-alone storage installations account for some of these capacity additions, aggregated market data indicate that hybrid solar-plus-storage projects are increasing in popularity.

“In 2022, the market pivoted from pilot-stage storage projects with tens of MWhs of capacity to GWh-scale battery systems,” says Bill Reaugh, head of power conversion technologies at engineering advisory firm VDE Americas. “We are currently supporting financing for roughly 3 GW of DC- and AC-coupled solar-plus-storage capacity scheduled to come online over the next 18 months. These systems are significantly larger than anything the industry has seen historically.”

Over the next five years, analysts expect the U.S. market to deploy 60 GW of battery energy storage capacity in grid-scale applications. Changes to the U.S. tax code resulting from the passage of the Inflation Reduction Act (IRA) will drive these BESS additions. Specifically, batteries no longer need to be coupled with renewable generation, such as solar or wind, to qualify for the Investment Tax Credit (ITC).

“Before the IRA, energy storage was eligible for the ITC only if the system primarily used PV generation to charge the battery,” Reaugh explains. “With the passage of the IRA, storage systems are eligible for a 30% ITC regardless of the energy source used to charge the batteries. Typical use cases for utility-scale solar-plus-storage projects include fixed-shape hedge applications, where the battery fills gaps in the solar power curve and extends its shoulders to help meet offtake agreement obligations, and more traditional energy delivery power purchase agreements. Developers also install batteries in purely merchant market applications, where energy storage operates as an alternative to natural gas peaker plants for late afternoon duck curve mitigation or ancillary voltage and frequency control support services.”

RISK MANAGEMENT

BESS adoption trends will shape project risk profiles in the coming years. The proliferation of new market entrants post-IRA will tend to increase supplier risk and bankability considerations. Operational risks will increase due to system and application complexity. Stored energy raises life and fire safety concerns. While these risks are manageable, the rate of technical change and innovation is daunting.

Solar-plus-storage system integration is considerably more complex than standard grid-tied PV power systems, requiring a battery, a battery management system, energy management software, and additional power electronics and monitoring. These products must not only work correctly but also work together. Components that perform well when tested individually may have issues when integrated with products from other vendors. The financial impacts of these reliability and availability problems are often consequential due to utility rate sensitivities when moving energy in time or dispatching power in parallel with a momentary spike in demand.

In addition to posing bankability and performance concerns, batteries also present unique safety considerations for owners and integrators. If a solar module or power optimizer fails, a corresponding amount of energy production is lost. When a battery goes into thermal runaway and fails, the fire hazards present a clear and present danger to persons and property.

As a highly accredited testing services provider, RETC works at the forefront of emerging technology markets and has seen these challenges firsthand. We are actively expanding our BESS testing capabilities, facilities, and throughput capacity to best support the next phase of the global energy transition. We will share lessons learned from these investigations in future technology reports.

—This article originally appeared in RETC’s 2023 PV Module Index Report.