Hail Risk and Solar Project Insurance

Whether the United States does its part to avert a global climate crisis could very well hinge on the solar industry’s ability to weather Texas hailstorms.

The insurance industry is the proverbial canary in the coal mine when it comes to climate risk. A century ago, caged canaries provided miners with an early warning that carbon monoxide or other toxic gases were present in harmful quantities. Today, insurance market destabilization is an early indication that carbon dioxide emissions are intensifying severe weather events and increasing climate risk to natural ecosystems and human economies.

Demonstrating the scale of insurance market instability, two top property and casualty insurance companies in the United States—State Farm and Allstate—recently announced that they will no longer provide new home insurance policies in California. The reason for this abrupt pullback from the nation’s most populous state is that eight of the 10 largest wildfires in state history have occurred since December 2017. Modeled attribution studies indicate that anthropogenic greenhouse gas emissions are the primary cause of the rising temperatures and declining precipitation fueling an increase in wildfire activity.

Insurance market destabilization is also taking place in Texas, a state whose solar market has national and international implications. Though best known for its oil and gas production and dubious distinction as the country’s largest annual emitter of carbon dioxide, Texas is also a renewable energy powerhouse. The Lone Star State not only leads the country in terms of wind power capacity, but also is poised to overtake California as the top solar market. Whether the United States does its part to avert a global climate crisis could very well hinge on the solar industry’s ability to weather Texas hailstorms—and insurers’ ability to quantify hail risk in fielded assets.

RISK TRANSFER MISMATCH

For the better part of a decade, solar project development benefited from a soft insurance market characterized by low rates and generous terms and conditions. In mid-2019, a severe hailstorm in West Texas shattered this age of innocence when it crossed directly over a West Texas solar farm. The resulting insured losses exceeded $70 million—a previously unimaginable amount, which contributed to the onset of a hardened insurance market and increased the costs of renewable energy project insurance.

“This one hail event in Texas is not entirely responsible for the subsequent market shift,” explains Sara Kane, practice leader for power and renewables at insurance brokerage CAC Specialty. “But the event marks the inflection point to the more restrictive insurance terms and conditions that have been the norm for the past four years. Overnight, insurers began to reunderwrite their books, increasing prices and introducing restrictive sublimits and deductibles to keep pace with the losses.”

In the wake of the 2022 hail season, the solar insurance in market went from hard to harder. According to insurance industry reports, severe hailstorms in Texas resulted in multiple loss events with cumulative solar project losses exceeding $300 million. Going into the year, it was difficult for brokers to find affordable insurance for projects in hail-prone regions. After these record losses, brokers are struggling to procure sufficient severe convective storm hazard insurance for hail-exposed solar projects at any price.

“After what happened in Texas last year, the challenges for sponsors and their brokers ramped up,” says Kane. “Solar project development in hail-prone regions is not slowing down. In fact, the opposite is true, as we continue to see more and bigger hail-exposed projects coming to market. Due to recent loss events, banks want to see higher natural catastrophe limits, whereas insurers want to provide a lower limit.

“The mismatch between what project stakeholders would like to procure and what the insurance market is willing to provide leaves customers stuck in the middle. Banks are evolving in their considerations on how to quantify natural catastrophe risk, which is generally leading to increasing limit requirements. Meanwhile, underwriters are looking to manage their aggregate exposure to natural catastrophe by limiting their capacity and increasing their pricing. And our clients are stuck in the middle trying to negotiate and procure a limit that is affordable and acceptable to financing parties. As a brokerage, we help to guide all those discussions and negotiations.”

PARAMETRIC INSURANCE

Some specialty insurance companies such as Descartes Underwriting offer parametric insurance products to help bridge the gap between the needs of traditional insurers and the finance community. Parametric policies pay out based on the occurrence of a specific event, such as severe hail. Moreover, payout amounts are indexed to a specific parameter, such as hailstone diameter.

“For severe convective storms, and hail in particular, we set up payout coefficients that correspond to specific hailstone diameters coupled with the amount of area impacted,” explains Brenden Beeg, Descartes Underwriting’s business development manager for North America. “As an example, 2.5-inch [63.5 mm] hail might pay out 25% of the limit at risk, which we then multiply by the impacted area percentage. As hailstone diameter increases, so does the payout percentage. So, 3-inch [76.2 mm], 3.5-inch [88.9 mm], and 4-inch [101.6 mm] hail might have payout coefficients of 50%, 75%, and 100%, respectively. The parameters and coverage amounts are highly customizable based on the client’s needs.”

In the wake of a qualifying hail event, parametric insurance providers use mutually agreed upon data sources—such as third-party weather data or on-site hail sensors—to quantify the magnitude of the parametric trigger. If the trigger value exceeds a predetermined threshold, the policyholder is entitled to a corresponding payout, independent of incurred losses.

“Parametric insurance is an extremely liquid kind of payout,” notes Beeg. “In the traditional property market, insureds likely go through burdensome forensic accounting during the claims adjustment process, leading to a lengthy period of time before receiving a claims payout. This can result in a very frustrating experience in the wake of a catastrophic loss. Index-based insurance is much cleaner that way. Following a triggering event, money typically flows within 10 to 15 business days after the parties execute a simple loss declaration statement.”

MITIGATING HAIL RISK

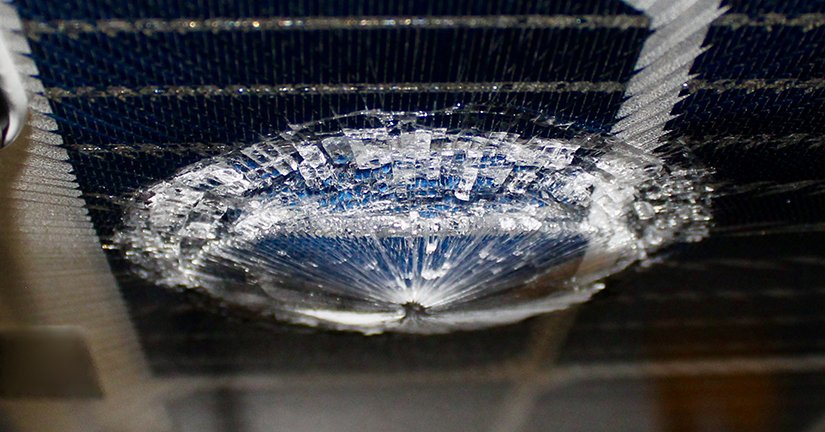

Deploying hail-resilient PV modules in hail-prone regions is an ideal way to mitigate a leading cause of severe weather losses. As a specialist in technical risk mitigation, RETC designed the industry’s first commercial beyond-qualification test program for severe hail. Recognizing that virtually all PV module designs pass the basic ballistic-impact tests required for product qualification, RETC’s Hail Durability Test (HDT) program exposes PV modules to impacts with higher kinetic energies.

By probing impact resistance at the threshold of damage, just over this threshold, and at the point of material failure, comparative HDT data can help project stakeholders differentiate PV product designs based on hail resilience and better understand real-world hail effects. As evidence, RETC recently conducted a statistical analysis of more than three years of HDT results—a data set that includes many different module sizes, power ratings, bills of materials, and manufacturers—analyzing the probability of module glass breakage as a function of effective kinetic impact energy.

Comparative freezer iceball resiliency curves for common c-Si PV module packages.

The results in the accompanying data visualization characterize hail resilience for two standard crystalline silicon (c-Si) PV module packages: 1) 3.2 mm (0.13 in.) glass superstrate with a polymer substrate, and 2) 2.0 mm (0.08 in.) glass superstrate with a 2.0 mm glass substrate. These resiliency curves indicate that PV modules with 3.2 mm front glass over a polymer backsheet are roughly twice as resilient to hail impact as dual-glass modules with 2.0 mm glass. The delta between the two probability is largely a function of glass thickness and strengthening. Whereas 3.2 mm solar glass is usually heat tempered, 2.0 mm solar glass is often heat strengthened only, to control material costs.

“As the decision-makers on solar glass specification and procurement,” says Cherif Kedir, president and CEO of RETC, “manufacturers are uniquely positioned to improve module hail resilience. Companies selling or buying hail-resistant products can use our HDT program to quantify module hail resilience. These differentiated products can mitigate financial risk in Texas and other locations that experience severe convective storms.”

TAKING IT TO THE LIMIT

Using RETC’s HDT data to identify and select hail-resilient modules, project stakeholders can significantly reduce financial risk exposure in hail-prone regions. Moreover, hail‑risk mitigation specialists can use ballistic-impact resiliency data to inform probabilistic financial loss estimates.

“Quantifying a PV module’s impact resistance is the first step toward a holistic understanding of hail risk in fielded assets,” notes Jon Previtali, head of natural catastrophe consulting at engineering advisory firm VDE Americas. “It is equally important to quantify hailstorm frequency and severity at the specific project location, which requires novel risk assessment approaches. Hail risk is also a function of the tracker’s defensive stow capabilities and the remote operation center’s emergency response capabilities.

“Science- and engineering-based assessments account for all these variables and characterize hail risk at the local scale of a solar power plant. In addition to providing probable maximum loss and average annual loss estimates to facilitate insurance discussions, our engineering advisory services can help owners and developers understand financial risk exposure over a specific hold period. The results of these financial models are useful not only for characterizing the benefits of hail-resilient system design approaches, but also for determining reasonable insurance coverage terms and convective storm sublimits.”

—This article originally appeared in RETC’s 2023 PV Module Index Report.